Herges Capital Services

Our Financial consultation Portfolio

Every investor is different. In a holistic approach, Herges Capital assesses the client’s current investments, obligations, needs and goals before recommending improvements. In a Statement of Investment Policy (SIP) overall risk preferences ranging from highly-conservative capital preservation to aggressive growth are bindingly agreed upon. The subsequent investment portfolio’s structure will match the client’s risk tolerance. Naturally, a retiree will emphasize more on reliable and steady investment income than a first job employee.

Investment Advising

Herges Capital composes and manages your taxable individual account or your tax-deferred or tax-free rollover retirement account. Common to all Herges Capital investment strategies is the aim to minimize the drag on performance due to third-party management fees, taxes (if applicable), transaction cost and uninvested cash.

Wealth Management

Herges Capital strives to support you in every aspect of your financial live. May that be optimal tax-savings, retirement planning or kids’ education funding. Ultimately, investment allocations will have to correspond to and adapt to your personal life situation and goals.

Taxes do have significant net return implications. It is important to apply an active, forward-looking tax minimizing investment strategy. Tactical asset allocation between taxable and non-taxable accounts (if both exit) can be optimized. The classical choice between traditional or Roth IRA is dependent on prospective taxes.

How much to put aside for what kind of retirement? Whether you are still in the accumulation phase or already retired, it is always insightful and motivating to have a meaningful projection. So to possibly correct spending or saving.

Trend Following

The alternative investment ‘trend following’ is a futures-trading strategy that exploits persistent price movements in commodities, stock indices, U.S. Treasuries and foreign exchange. Exclusively high-net-worth individuals may become investors and a separate futures account will have to be opened.

This investment’s appeal lies in the low correlation and therefore high diversification potential versus traditional asset classes, like stocks, bonds or real-estate. In contrast to traditional long-only investments in stocks, bonds and real-estate, futures can just as easily be sold as bought. This characteristic ensures that independent of particular conditions in other markets trend-following is possibly able to, and indeed aims to, produce a positive return in all circumstances.

THE ADDITION OF MANAGED FUTURES TO A PORTFOLIO DOES NOT MEAN THAT A PORTFOLIO WILL BE AUTOMATICALLY PROFITABLE, THAT IT WILL NOT EXPERIENCE SUBSTANTIAL LOSSES OR VOLATILITY AND THAT THE RESULTS OF STUDIES CONDUCTED IN THE PAST MAY NOT BE INDICATIVE OF CURRENT TIME PERIODS OR OF THE PERFORMANCE OF ANY INDIVIDUAL CTA.

What is an Investment Advisor?

About

Investment Advice

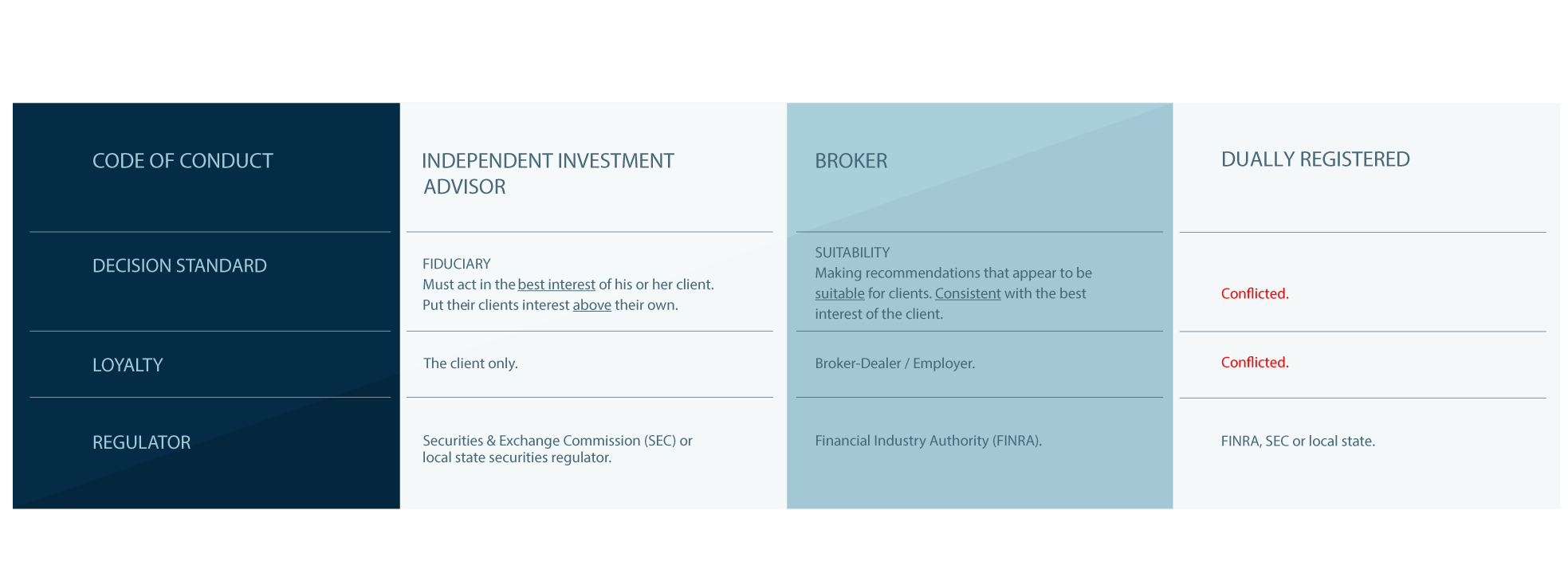

It is paramount knowing with whom exactly you speak about your investment activities. There are three types of financial advisors:

a) Brokers work for broker dealers or insurances. They earn commissions on the products they aim to sell to you. When doing so they are not required to have your best interest in mind. Brokers are only subject to a suitability standard. Their ultimate loyalty is to their employer and the profitability of those institutions.

b) In contrast, Registered Investment Advisors (RIA) are by federal law obliged to act in your best interest only. They are bound to the highest, the so-called fiduciary standard.

c) Some firms are dually registered as RIA and broker. While they might have the best intentions, the problem is you never know in which role they advise you at that very moment. At any time those professionals are possibly conflicted between your best interests and their potential commission. Those financial advisors are therefore to be avoided.

There is absolutely no reason to entrust your hard-earned money to a broker when instead you can work with a non-conflicted investment advisor. Only 8% of all financial advisors are independent investment advisors, not being simultaneously a broker or linked to one. Herges Capital belongs to that rare group.

A highly-recommendable book deals with that topic in chapter 5 ‘Who can you really trust?’ in ‘Unshakeable’ by Tony Robbins.

Why Herges Capital?

15 Years of

Experience

State Registered

Investment Advisor

FIDUCIARY NOT

a Broker

Contact us for a free Consultation

Often an initial step for investors is to trustfully forward their latest broker’s statement for us to comment on. Common are also requests to recommend funds out of a 401k program. In both cases fees and sufficient diversification guides our reply.